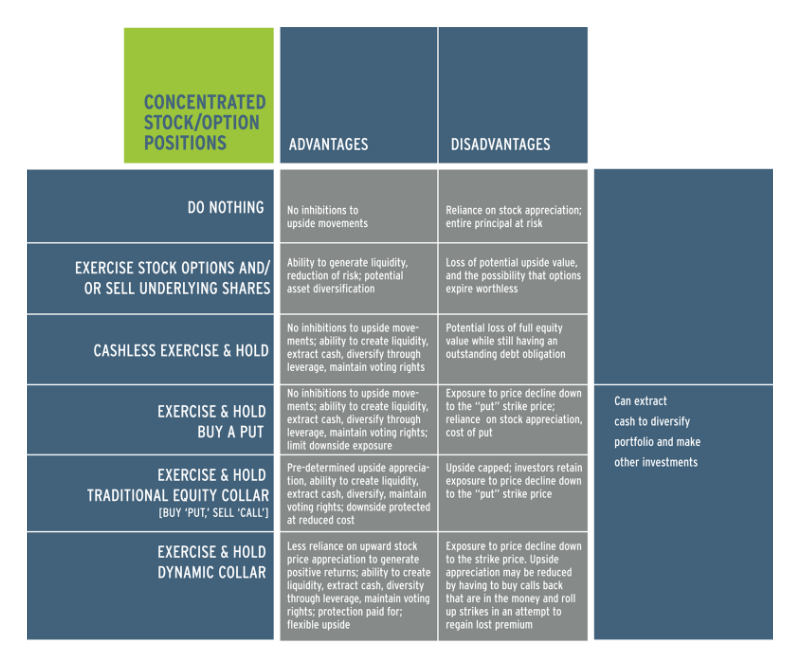

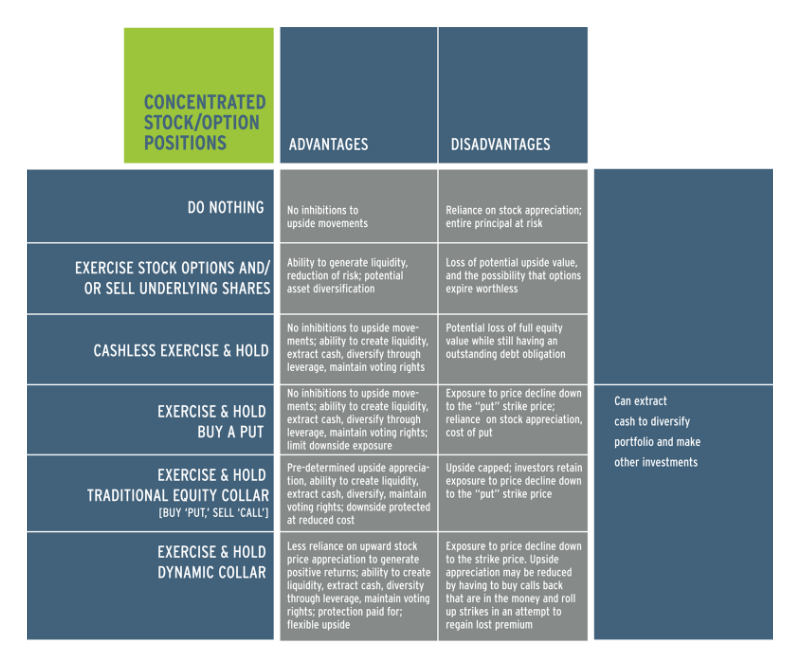

Concentrated Stock/Options Positioning

Put your holdings to use:Using Puts and calls dynamically enables passive holdings to be protected and monetized. |

Cash extraction:There is the opportunity to extract cash without selling shares. |

Generates income:Calls can help ensure maximum utilization of assets through income generation, and enhanced returns. Increases likelihood of positive returns. |

Mitigate Risk:Levels of protection may be set to your needs while performance risk tied to share price direction is reduced. Our Dynamic Collars prepare you today for the unforeseen tomorrow. |

We take the best of the traditional equity collar and add a dynamic element—which allows us to be responsive to share price, market moves, current events and the changing needs of our clients. Our dynamic collar provides a flexible alternative that does not intend to cap the upside potential and attempts to increase the probability of positive returns.

Purchase put protection generally extending only six months providing a floor for shares at levels set to client needs. This duration allows us to adjust the “floor” as needed. If the stock price moves higher, put protection can be adjusted higher (“rolled up”) to protect the appreciated value of the underlying security.

Covered calls—or the “cap”—usually sold on a monthly or short-term basis. The time-frame is adjusted based on individual client needs and the assessment of specific option values. The cash generated from selling calls may be used to offset the cost of put protection and compliment the overall performance of the security by providing yield.

Calls and puts are adjusted dynamically. At times, to capitalize on the underlying market volatility, calls may be bought back and resold prior to their expiration. This cycle may continue based on the changing share price in an attempt to lock in profits, collect additional premium, allow room for the stock to move higher, or limit losses. If the underlying share price exceeds the option strike price and the investor does not wish to sell the underlying shares, the call contract may be closed out, eliminating a sale. There is the potential for a loss the call must be repurchased for more money than its original selling price. If shares are called away prior to the expiration date, new shares can be purchased to fulfill the delivery obligations of the contract, thus avoiding a constructive sale.

Deploy income generated by the underlying position. This income may be used to create a diversified portfolio, cash extraction/liquidity, and or to repay debt incurred from the exercise and hold of stock options. We will work with you to ensure the possibilities are made clear, in light of your goals and plans.

* If your portfolio is highly concentrated, email us or call us at 212-320-2040 for a full discussion of how best to protect it.

* Please see Glossary for an explanation of certain terms contained herein.